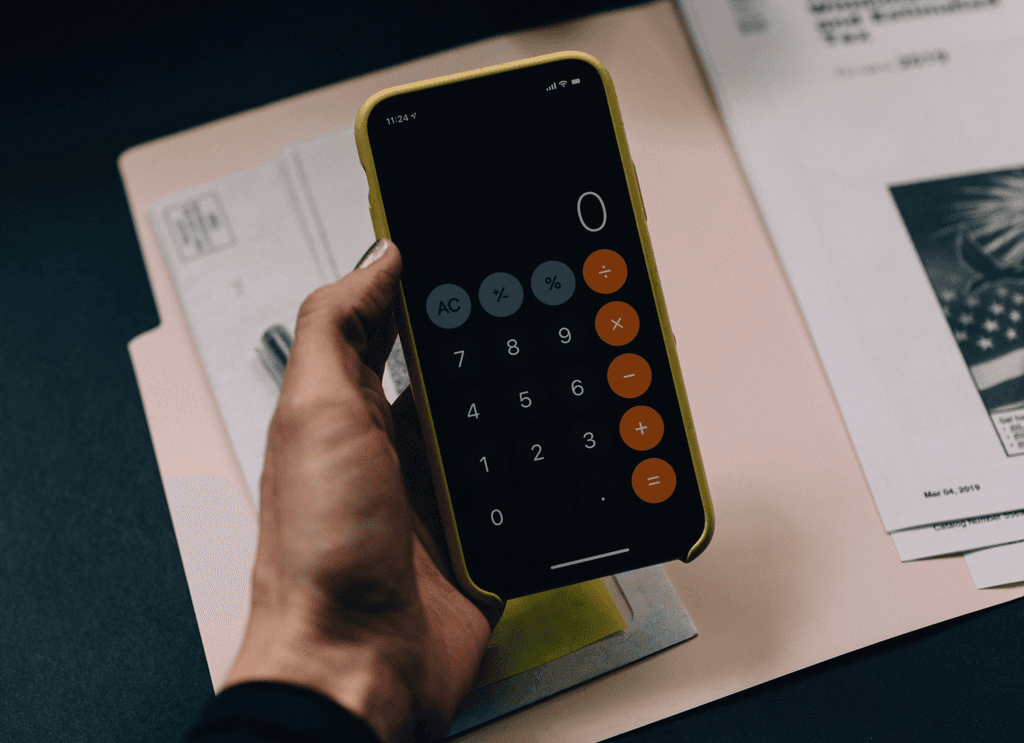

Professional tax & business services across South Africa

At BayTax we specialise in personal and business tax returns, company registrations and trust administration. Our qualified practitioners ensure accurate filings and compliance with SARS regulations, helping you focus on what matters most—running your business or managing your personal finances.

Get Started

Individual Tax

Personalised assistance with all aspects of your personal tax return. We prepare and submit your SARS return, optimise allowable deductions (such as medical aid, retirement annuities and investments) and make sure you remain fully compliant.

Learn More

Business Services

From registering a new company to filing tax returns and managing amendments, we provide comprehensive corporate services. We help keep your business compliant with CIPC and SARS, streamline your accounting processes and reduce administrative burdens.

Learn More

Trust Services

Expert guidance for trust taxation and administration. We handle tax returns, provisional tax filings and annual declarations, allowing trustees to protect and grow their assets while remaining compliant with South African law.

Learn More

What we do

Preparation and submission of company income tax returns, ensuring you meet deadlines and take advantage of all applicable deductions.

Tailored preparation and submission of personal tax returns, including salary, investment income, retirement annuities and capital gains.

Hassle‑free registration of new companies with CIPC, including name reservation, incorporation documents and B‑Bee certificates if required.

Efficient updating of directors, shareholders, addresses, and other company information to stay compliant with Companies Act requirements.

Comprehensive trust tax return services for managed or passive trusts, including distributions and beneficiary schedules.

Calculation and submission of provisional tax for individuals, companies, and trusts to avoid penalties and manage cash flow.

Filing of annual returns with CIPC and SARS to maintain good standing and prevent deregistration.